tax on venmo over 600

1 2022 a provision of the 2021 American Rescue Plan requires earnings over 600 paid through digital apps like PayPal Cash App or Venmo to be reported to the IRS. Thanks to the new American Rescue Plan Act of 2021 services like Venmo and Cash App will now begin sending out 1099-K tax forms to.

Pin By Groundtofork On Useful Info In 2022 Give It To Me Goods And Services Venmo

What Im seeing is that if you receive more than 600 total through digital payment platforms such as cashapp venmo paypal etc you will be taxed through form 1099-K.

. Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a payment of more than 600. If you dont end up earning at least 600 from these payments on Venmo you can always download your account statements to help you with any reporting obligations. According to FOX Business.

1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099-K for them reporting. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. If you earn at least 600 in payments from goods or services on Venmo during the calendar year well issue you a Form 1099-K at the beginning of the 2023 tax season and send a copy to the IRS.

Sign Up For Venmo Get 10. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS. Social media posts like this TikTok video that was published on September 26 and racked up 340000 views have claimed that starting January 2022 if you receive more than 600 per year through third-party peer-to-peer payment apps like Cash App Venmo or Zelle you will be taxed on those transactions.

Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200 transactions and 20000. So the sending of money back and forth for personal purposes eg paying for your share of dinner with friends does not require any tax reporting. One Facebook post claims the new tax bill would tax transactions exceeding 600 on smartphone apps like PayPal and Venmo.

If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic payment networks you could be affected by a tax reporting change that goes. WJBF A change from the IRS may complicate next tax season for small business owners who use apps like Venmo or PayPal. Business Venmo transactions over 600 taxed.

Offer Ends March 31 2022. Venmo tax reporting The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash. 1 if a person collects more than 600 in business transactions through cash apps like Venmo then the user must report that income to the IRS.

Offer Ends On March 31 2022. The crucial word being income. Current tax law regardless of the new rule requires anyone to pay taxes on income more than 600 regardless of where it comes from.

I keep seeing this rule being shared all over but Im not sure how I would be affected. No Venmo isnt going to tax you if you receive more than 600. Under the IRS new rules the online payment giants such as Venmo PayPal and Cash App were told to report commercial transactions of 600 or higher starting January 1.

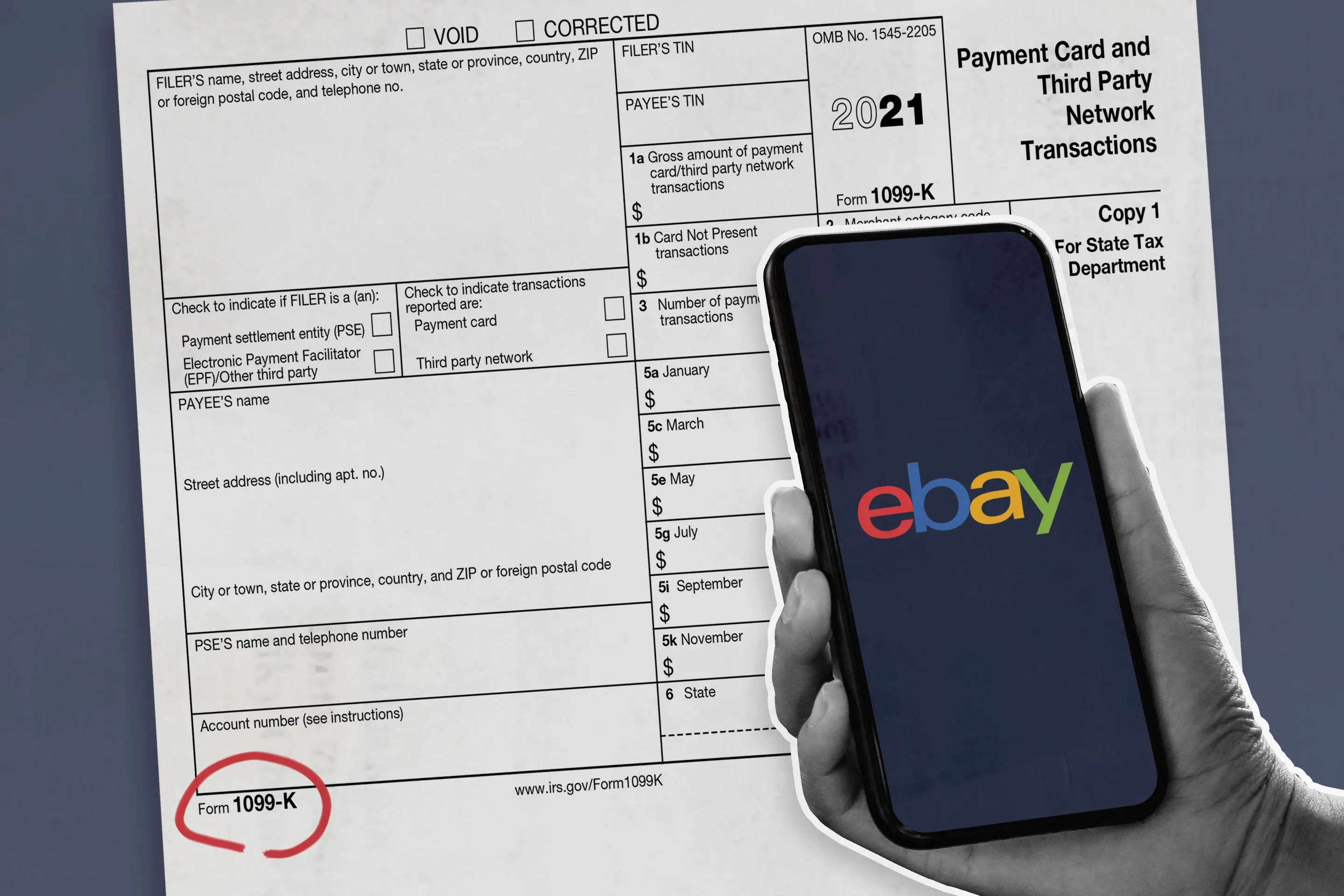

Going out to dinner with your friends shopping reimbursement for concert tickets rent groceries utilities etc does not count as income those are simply expenses and discretionary spending. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. As long as youre not making additional income over 600 via these apps you should be in the clear.

The crucial word being income. Yes users of cash apps will get a 1099. Rather small business owners independent contractors and those with a.

That means if you borrow money using any of those things over. As of Jan. Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps.

Previously these mobile payment apps only had to tell the tax authorities when a person had over 200 commercial transactions per year that exceeded 20000 in total value the IRS said. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS.

Currently online sellers only received these forms if they had at least. Ad Get 10 When You Sign Up For Venmo. Me and my boyfriend easily send each other well over 1k a year each using venmocashapp.

Current tax law regardless of the new rule requires anyone to pay taxes on income more than 600 regardless of where it comes from. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

Tax Changes Coming For Cash App Transactions

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Proposed U S Rule Would Force Reporting Of All Accounts Of 600 Or More Funny Memes Funny Funny Pictures

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Pin By Sherry Willhelm On Important To Know In 2022 Give It To Me Goods And Services Meant To Be

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

New 600 Tax Law In 2022 Money Apps Tax Law

Hilo Income Tax Service Home Facebook

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-05-2022/t_922560b2db1b4cd3a10b798a2d631ae6_name_Venmo_Paypal_must_report_payments_of_600_61d595b2283c07051d1095e4_1_Jan_05_2022_13_11_02_poster.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Fox13 News Memphis

Capital One Automatically Disables Early Direct Deposit At The Right Times To Make Filing Your Taxes Easier R Antiassholedesign

Pampered Pets Salon Home Facebook

Gifted Hands Tax Professional Accueil Facebook

Most Cool Toys And Gifts For 7 Year Old Boys 2022 Video Video Christmas Gifts For Boys Christmas Gifts 7 Year Old Christmas Gifts

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Ios 14 App Icons Posh Silver Glitter Sparkle Black Moody Etsy App Icon Homescreen Iphone App

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

Consider Using Their Tax Refund Toward A Down Payment Contact Brad Today To Start Shopping For That Next Home Tax Refund Down Payment Home Buying

I Did My Taxes For Rover Last Night Here S My Experience R Roverpetsitting